Colorado is one of the 25 states in the US that increased its minimum wage in 2025. We've compiled this guide to help you make sure your business meets the minimum wage requirements. Here, you'll find answers to the most popular questions about Colorado's minimum wage and information about other minimum wage guidelines. We've also included links to Colorado's government website if you want to do more research on a particular subject. Let's dive in.

What is the statewide minimum wage in Colorado?

Colorado's minimum wage in 2025 is $14.81 per hour ($11.79 with a $3.02 tip credit), according to the Division of Labor Standards and Statistics. If tipped employees—like food and beverage workers—don't make $14.81 per hour from their base pay and tips, employers are required to make up the difference. This tip credit system allows restaurants (and other businesses that rely on gratuities) to keep labor costs down.

Colorado's minimum wage is $7.17 higher than the federal minimum wage, which is at $7.56 in 2025. This is due to Colorado's higher cost of living. According to MIT's Living Wage Calculator, Colorado's living wage ranges from $24.83 to $76.52, depending on the number of adults and children in a family.

Did the minimum wage in Colorado increase in 2025?

Yes. Colorado's hourly minimum wage went up from $14.42 in 2024 to $14.81 in 2025, a difference of $0.39. Since Colorado passed its first minimum wage laws in 1935 at $0.35 per hour, its minimum wage has been steadily rising. In 2010, the Colorado minimum wage became aligned with the Consumer Price Index (CPI), a national index that measures the change in prices paid by US consumers. As the CPI goes up, so does Colorado's minimum wage. Check out the chart below to see Colorado's minimum wage increase over the years.

Minimum wages in Colorado counties

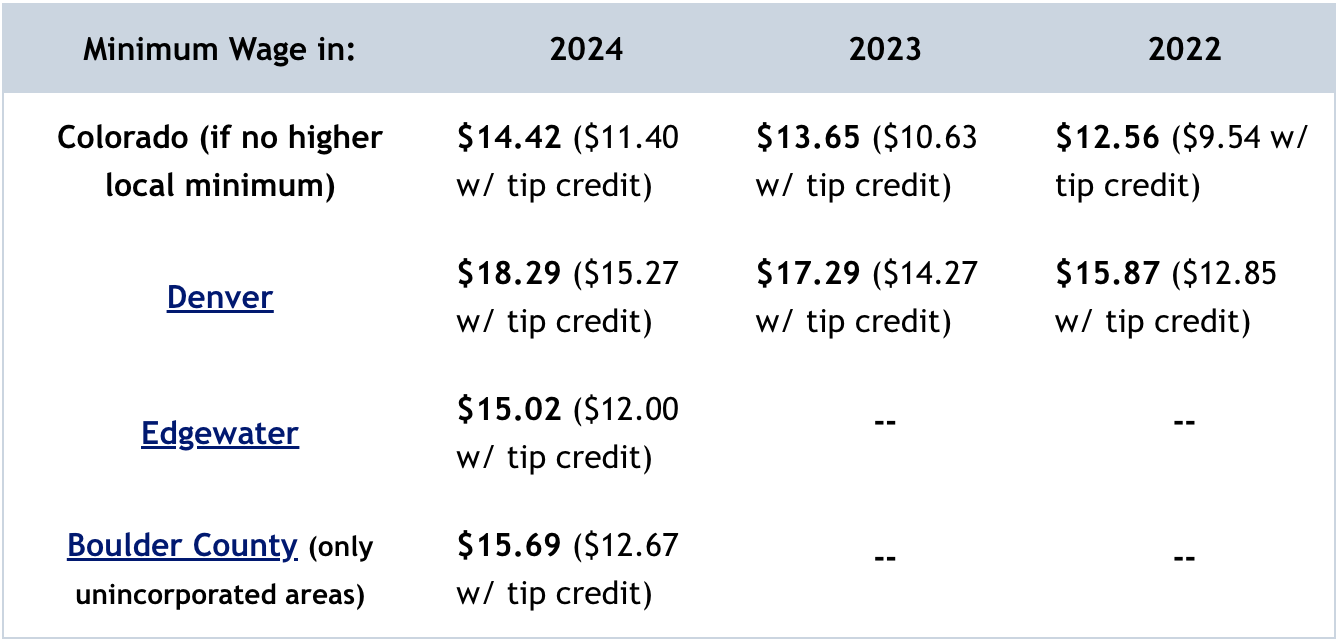

Three counties in Colorado—Denver, Edgewater, and Boulder—have local minimum wages, making them higher than the statewide minimum wage. Denver first established its local minimum wage in 2022, while Edgewater and Boulder were in 2024.

What is the minimum wage in Denver?

Denver's minimum wage in 2025 is $18.81 per hour for untipped workers and $15.79 per hour for tipped workers. This is $4.00 higher than the Colorado statewide minimum wage ($14.81 untipped). The increased minimum wage in Denver is a result of its high living wage, which ranges from $25.62 to $75.08, depending on the number of children and adults in a family.

Like Colorado, Denver's minimum wage is tied to the Consumer Price Index and will increase annually. In 2025, it will be $18.29 + the CPI. In 2023, Denver's minimum wage was $17.29 ($14.27 with a $3.02 tip credit). And in 2022, it was $15.27 ($12.85 with a tip credit).

What is the minimum wage in Boulder?

Boulder's minimum wage in 2025 is $16.57 ($13.55 with tip credit), which applies only to unincorporated areas. It is $1.65 higher than the statewide minimum wage of $14.81.

What is the minimum wage in Edgewater?

Edgewater's minimum wage in 2025 is $16.52 ($13.50 with a tip credit). It is higher than the statewide minimum wage of $14.81.

What is the minimum wage in Colorado Springs?

Colorado Springs's minimum wage in 2025 is $14.81 per hour ($11.79 per hour with a tip credit), the same as the state minimum wage.

What is the minimum wage in Pueblo?

Pueblo's minimum wage in 2025 is $14.81 per hour ($11.79 per hour with a tip credit), the same as the state minimum wage.

Who does the Colorado minimum wage rates apply to?

The 2025 Colorado minimum wage is for all employees covered by the Colorado Overtime and Minimum Pay Standards Order or COMPS Order. This includes:

- All private sector work, except for exempt jobs and employers.

- “Employers” and “employees,” not others such as independent contractors. Whether an individual is an employee or independent contractor depends on the actual facts, not just what documents say (contract, 1099 tax form, etc.) — for more detail, see Interpretive Notice and Formal Opinions (INFOs).

- Workers with non-hourly pay (salary, piece rate, commission, etc.) still must be paid at least minimum wage for all time worked unless the employee is exempt from the minimum wage.

In certain situations, employers can pay less than the full minimum wage:

- Employers can pay most minors (with the exception of “emancipated” minors) 15% below the full minimum wage. A minor is anyone under 18, except someone who has received a high school diploma or who has passed the GED exam.

- As mentioned above, employers can claim credits against wages owed (like for tips received) and make some deductions (like for employee meals) — with important limits and conditions.

Colorado minimum wage deductions, credits, and charges

The Wage Act limits deductions from wages (C.R.S § 8-4-105), and the COMPS Order details various specific deductions, credits, and charges:

- Lodging credits are allowed if the housing situation is:

- Voluntarily accepted by the employee

- Primarily for employees' (not employer's) benefit and convenience

- Recorded in a written agreement

- At most, $25 to $100 weekly, depending on the lodging type.

- Meal credits are allowed for the cost or value (without profit) of meals that employees voluntarily accept.

- Uniforms that are ordinary, plain, and washable clothing (with no special color, make, pattern, logo, or material required) need not be provided. But employers must pay for particular uniforms or special apparel. Employers can’t require deposits or deduct for ordinary uniform wear and tear.

- Tip credits of up to $3.02 per hour may offset wages of employees regularly receiving over $1.64 per hour in tips they (A) directly receive (e.g., waitstaff or hotel housekeepers), or (B) share among employees who perform significant customer-service functions in contact with patrons.

Does Colorado have an overtime minimum wage?

Yes. Employers must pay 1½ times an employee’s regular rate of pay (“time and a half”) for hours past either 40 hours per week, 12 hours per day, or 12 consecutive hours—whichever results in higher pay.

When determining overtime, employers are not allowed to:

- Add or average hours in multiple weeks. For example, a 50-hour week includes 10 hours of overtime, even if the employee works only 30 hours the week before or after.

- Can’t provide time off instead of time-and-a-half overtime pay—sometimes called “comp time.”

For more information on overtime, read Colorado's Interpretive Notice & Formal Opinion (“INFO”) # 1.

More minimum wage guides

- Texas Minimum Wage Guide

- Michigan Minimum Wage Guide

- California Minimum Wage Guide

- Illinois Minimum Wage Guide

- New York Minimum Wage Guide

- Florida Minimum Wage Guide

Stay labor-compliant with the right tech

With the right labor management software, restaurants can make sure they're paying staff correctly and adhering to minimum wage regulations. SpotOn Teamwork enables operators and owners to automate payroll, stay compliant with local labor laws, do weekly schedules in minutes, and simplify staff tip-outs. And when you're team is happy, so are your guests.

DISCLAIMER: Everything here is just for informational purposes. The links and graphics may not be accurate and we encourage you to do your own research. Also, we can't guarantee results from following our advice. Always consult a professional for your specific situation.