If you’ve ever seen a gas station sign with two sets of prices on it—one for cash and another for credit cards—then you’re already familiar with dual pricing. More commonly known as a cash discount program, dual pricing is a common pricing strategy to give customers the choice to pay with cash instead of a credit card, thereby avoiding credit card processing fees. It’s legal in all 50 states and it’s not just for gas stations. With the right restaurant POS or small business POS system, any type of business can run a compliant cash discount program.

But just because you can, it doesn't mean you should. Done poorly, cash discounting can chase off customers and even saddle you with penalties from the major credit card brands. This guide will illustrate how a cash discount program works, how it's different from a surcharge program, how to decide if it's right for your business, and (if so), how to implement one correctly.

Jump to →

- What is cash discounting?

- How is cash discounting different from surcharging?

- What type of business is a good fit for a cash discount program?

- How to decide if cash discounting is right for your business

- How to implement a legally compliant cash discount program

What is cash discounting?

Cash discounting, or dual pricing, is a pricing model where you offer a discount to customers who pay with cash. Cash discounts typically range between 3-5%. This provides a benefit to cash-paying customers while helping you offset processing fees from credit and debit card transactions—if set up correctly.

To truly offset payment processing fees with a cash discount program, you will want to raise the posted prices on all your items, typically by the same percentage as the cash discount. This increase in prices is then used to offset debit and credit card fees.

- For restaurants, this means updating menus, menu boards, and your your point-of-sale

- For retailers and other small businesses, this means updating price tags, brochures, signs, etc., as well as your point-of-sale

Once your posted prices are updated, you then offer a discount from the published amount to customers who use cash as payment method.

Typically, cash discount programs are implemented with a payment terminal or POS device that is configured to offer both cash and credit prices. If the program is not set up correctly, however, you could receive compliance violations and even be fined, so it's important to understand the requirements and partner with a POS provider that has a compliant program.

Cash discounting rules and requirements

Your advertised prices must show the price for credit card transactions

For your cash discount program to be compliant with Visa, Mastercard, and other card networks, you must advertise the credit card price to your customers. You can do this by either displaying the credit card price as your posted price or by displaying both cash and credit prices like gas stations do.

You must display clear signage

Your cash discount program should be clearly communicated to your customers. Typically, this means displaying signage that's readily visible to your customer specifying the percentage of your cash discount and that cash discounts only apply to cash payments.

This can include:

- Signage at the entrance to your business

- On your menu

- Signage at the cash register

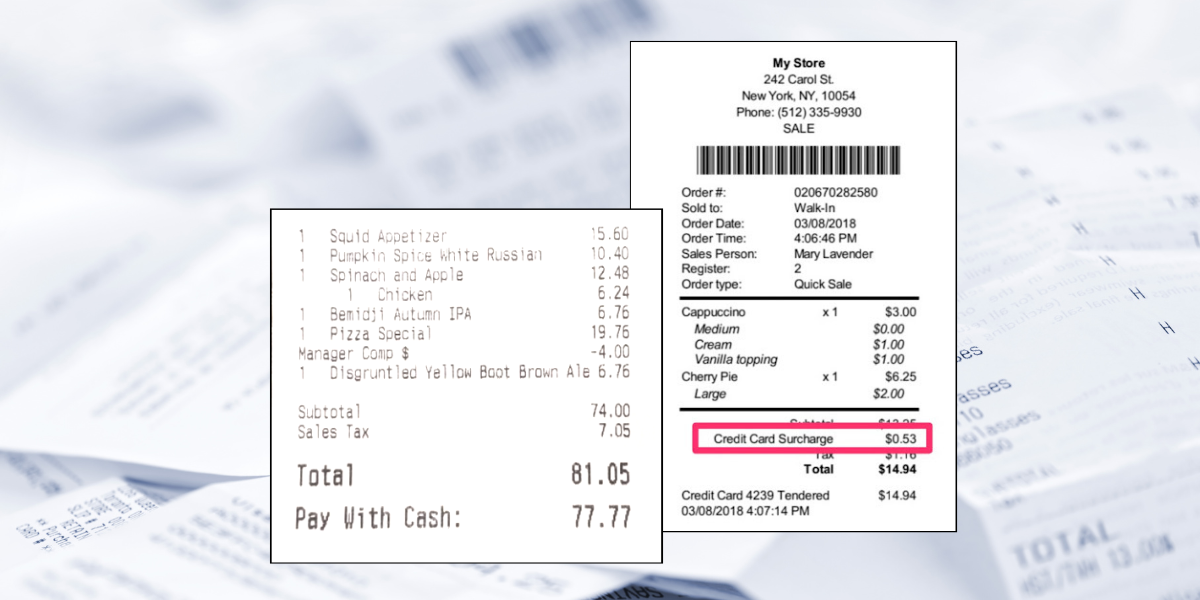

Receipts should display the cash discount

Your POS system should also be configured so that it shows a line item explicitly stating that the cash discount is for cash payment only, and also specify the discount percentage. For example, a 3% cash discount on a $100 meal at a restaurant would show a line item for a $3 cash discount.

How are cash discount programs different from surcharging?

A surcharge is a line-item fee that is added on top of the normal purchase price when paying with a credit card. In essence, it allows you to offset some or all of your credit card processing fees by passing those charges on to your customer.

Unlike cash discount programs, surcharging is not legal in all 50 states.

- Surcharging is prohibited in Connecticut, Maine, and Massachusetts

- Oklahoma and Colorado limit their maximum surcharge rate to 2%

- New York requires that you post both cash and credit card prices

Additionally, the credit card brands also have their own rules around surcharging. Visa, for example, lowered their maximum surcharge amount from 4% to 3% on April 15, 2023, and requires that you register your surcharge program through your payment processor or acquiring bank.

Surcharging also differs from cash discounting in two other important ways. First, cash discounts are communicated to customers as a discount from the regular price, whereas a surcharge is an added fee. While both pricing plans can rankle customers, surcharging, in particular, can come across as an unfair fee that might deter customers from doing business with you.

Second, a cash discount program requires a more sophisticated configuration on your payment terminal or point-of-sale system. Rather than simply adding an extra fee, your payment device needs to be programmed to charge the posted price by default and show the discounted price for cash-paying customers.

Is cash discounting legal?

Yes, compliant cash discounting is legal in all 50 states because it involves offering a discount to cash paying customers as opposed to adding a fee for customers who pay with a card. (See Surcharging below for more information.

What are the benefits of offering a cash discount?

A cash discount program has numerous benefits:

- It enables you to offset card processing fees

- It incentivizes customers to pay in cash, which could reduce the risk of chargebacks and fraud, while also improving cash flow

- Customers tend to be more receptive to a discount as opposed to a fee (as with surcharging)

- Set up correctly, it is legal in all 50 states

What type of business is a good fit for a cash discount program vs surcharging?

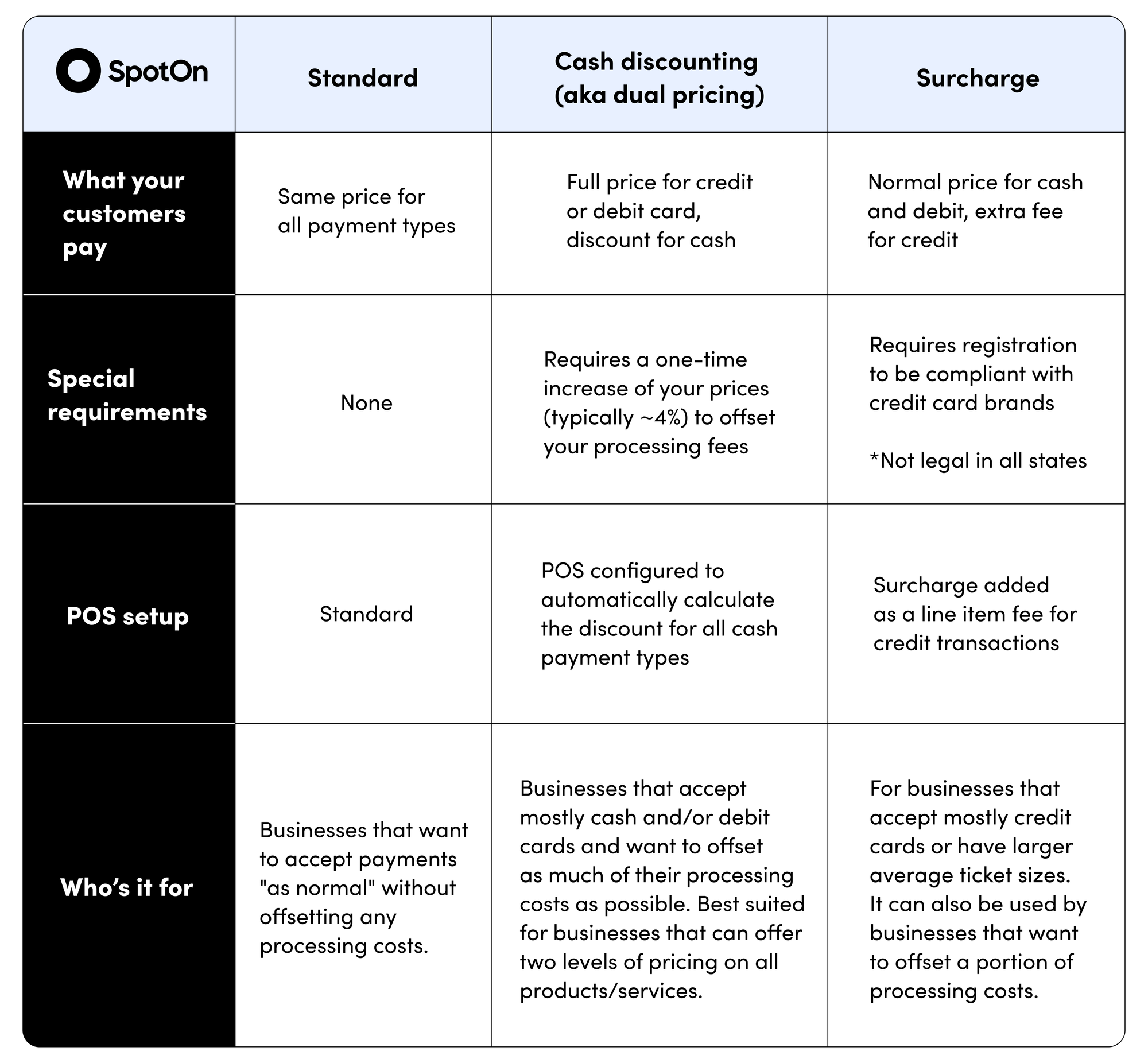

Cash discount programs can be a great way to offset costs, but it's not right for all types of business. This chart compares standard pricing models versus cash discounting and surcharging.

How to decide if cash discounting is right for your business

While a cash discount program or surcharge may sound alluring, especially if you're currently paying high credit card processing rates, there are several factors to consider when deciding whether dual pricing will help or hinder your bottom line.

1. How do your customers prefer to pay?

This is the most important factor when considering a cash discount program. If most of your customers already pay with cash, then offering a cash discount makes a lot of sense. You can raise your listed prices—which only customers paying with cards will have to pay—and your regular cash-paying customers get to pay the same cash price they expect. You make the extra revenue you need to pay for credit card fees and your core customers stay happy. Win, win.

On the other hand, if most of your customers are paying with a credit card, a cash discount program can come across as an unfair punishment targeted at them. Particularly if you run an upscale business or are located in a metropolitan area, a cash discount may be a deterrent to customers, although it certainly would be better received than a surcharge program.

Fair or not, the customer perception is often that you're being cheap or that your business is unsophisticated. After all, your pricing already takes into account your other business expenses such as rent, wages, and supplies. Why wouldn’t your pricing account for credit card prices, too?

2. Will you miss out on increased sales?

Study after study has shown that consumers spend more when using a card rather than cash. According to Forbes Advisor, 76% of people prefer using a card over cash and people are twice as likely to spend more when using a card compared to cash. Add in the growing popularity of mobile pay methods like Apple Pay and Google Pay (which are charged as credit card transactions), and you may not be serving your card-paying customers well with a cash discount plan.

3. Is there an easier way to reduce credit card processing fees?

Be sure to look at the fine print from your payment processor when considering a cash discounting plan. Typically, your credit card processing costs are much higher with cash discounting. Yes, this is accounted for by raising the full price on all your items, but at the end of the day, if you’re going to raise your prices anyway, why not do it yourself and negotiate the best effective credit card processing rate you can get?

4. Is it worth paying extra to have a payment professional set it up for you?

Perhaps the biggest benefit to cash discounting or dual pricing is having a merchant services provider who you trust that can do all the heavy lifting for you. Raising prices on your own and making sure you are set up up with a true cash discount program that is fully compliant can be technically challenging. A trusted technology partner can not only help you save money but also save time and give you peace of mind that you're following card brand rules and fully compliant.

At SpotOn, for example, our team will help you assess your current credit card rates and work with you to determine the pricing model that makes the most sense for your business. If cash discounting is right, they’ll help you choose the cash discount rate, get the signage you need, and ensure your payment terminal or POS is set up correctly—so that it’s easy for you, clear for your customers, and compliant.

How to implement a legally compliant cash discount program

If you've decided that a dual pricing or cash discount program makes sense for your business, follow these steps to ensure your program is compliant and minimizes negative customer sentiment.

1. Choose your cash discount percentage

First, decide how much of a cash discount you want to offer to customers who pay with cash. Most cash discounts range between 1% and 4%. You'll want to consider your average ticket or transaction price when making this decision. Generally speaking, the higher your average transaction, the lower you'll want your cash discount percentage to be and visa versa.

2. Increase your pricing

Assuming your goal is to save money by reducing payment processing costs, then you will want to raise your listed prices when implementing your cash discount program. This is the new price that customers paying with cards will pay.

There are not any rules regulating how much you can raise your prices. Rather, you'll want to consider how your card paying customers will react to the price increase.

Typically, SpotOn recommends raising your prices by the same amount as your cash discount, as this will offset the majority of your payment processing costs.

3. Program your POS with the cash discount and updated pricing

If you have a menu or product catalog programmed into your POS, you'll need to update the prices to show the new price increase. This is a crucial step. In order to be compliant, the price in your POS must show the credit card prices as the listed price, not the cash prices. Your POS provider should be able to help you with this process or you can use a bulk price editor feature.

Next, you'll need to program the cash discount into your POS so that the cash discount shows up as a line item discount or shows both cash and card prices (aka dual pricing). If your POS and receipts display a service fee instead of a discount, then your program is not compliant.

For all these reasons, we highly recommend partnering with a trustworthy POS provider that has experience implementing compliant cash discount programs.

4. Update menus, pricing boards, and brochures

It's important to show your customers the full price they will pay with a credit or debit card. If you increase your pricing, that means you not only need to update your POS but also anywhere you advertise prices to your customers:

- Menus (both print and digital)

- Pricing boards

- Website

- Brochures

In addition to showing the updated prices, you'll also want to add a note that you offer a cash discount and specify the percentage.

5. Post clear signage

The same cash discount notice that you include on your menu or pricing brochures should also be displayed prominently at your business. Typically this would include placing a sign at the entrance to your business and at the checkout stand.

The messaging doesn't need to be fancy. It can simply say, "As a convenience, we offer a 3% discount if you pay with cash."

6. Train your staff

Lastly, make sure your team is trained on how your cash discounting program works. This includes making sure anyone running your POS knows how—and when—to apply a cash discount during checkout, and also ensuring that any staff who interact with customers are comfortable explaining the program.

The program should be explained as a discount and/or convenience to customers, not as an extra fee or surcharge for customers who pay with a card. At the end of the day, the success of your cash discount program will depend on how well you and your team communicate it to your customers.

DISCLAIMER: Everything here is just for informational purposes. The links and graphics may not be accurate and we encourage you to do your own research. Also, we can't guarantee results from following our advice. Always consult a professional for your specific situation.